Sustainable Real Estate Solutions: Technology & Products That Drive Green Property Investment

Why Sustainable Real Estate Matters

Sustainable real estate refers to properties designed, built, or operated to minimize negative environmental impact and enhance social/health outcomes while maintaining financial returns. As climate risk, regulation, and tenant demand intensify, sustainability becomes a strategic differentiator.

On the environmental side, buildings are major contributors to greenhouse gas emissions, energy and water consumption, and waste. Upgrading a building to be more energy-efficient, reducing resource waste, or integrating renewable energy helps reduce long-term operating costs and carbon liabilities.

From a financial or investment perspective, “green” properties often command higher rents, lower vacancy, longer lease terms, and greater appeal to institutional investors. Many investors now require ESG metrics or sustainability disclosures before funding real estate deals. In short: sustainable real estate is increasingly tied to capital access, risk mitigation, and long-term value preservation.

Moreover, regulatory frameworks globally (carbon taxes, emissions reporting, building codes) are tightening. A building that cannot adapt to those future rules risks obsolescence or being treated as a “stranded asset.” So sustainability is not just idealism it is pragmatism.

Core Technologies & Principles in Sustainable Real Estate

To deliver real sustainable real estate, property owners rely on a combination of design principles, operational strategies, and enabling technologies. Below are key elements that must integrate.

Passive Design & Envelope Efficiency

The foundation of sustainability lies in the building design itself. Passive design strategies such as orientation, daylighting, natural ventilation, high performance insulation, shading devices, and airtight construction reduce heating, cooling, and lighting loads upfront. For example, the Passive House (Passivhaus) standard ensures ultra-low energy demand in many climates.

Using eco-efficient materials with high thermal performance or reflective properties can further reduce cooling demands in hot climates. These design choices reduce the baseline energy load even before you deploy active systems.

Smart Building & IoT Systems

Once the design is optimized, smart systems monitor, control, and optimize operations. Sensors, controllers, building automation systems (BAS/BMS), and analytics platforms allow you to track occupancy, energy, lighting, HVAC usage, water consumption, indoor environmental quality, and more.

For instance, if occupancy sensors detect a meeting room is unused, lighting or HVAC can shut off automatically. If temperature/humidity data triggers thresholds, the system can adjust ventilation. The intelligence layers detect faults, inefficiencies, and opportunities for savings, enabling continuous optimization.

Renewable Energy & Storage Integration

To reduce dependency on grid electricity (often fossil-derived), integrating solar photovoltaic (PV) systems, small wind, or other renewable sources is vital. Paired with battery storage or microgrid control, buildings can operate more autonomously or even export energy.

In many modern smart buildings, energy management systems (EMS) coordinate loads, shift consumption, and integrate battery dispatch decisions. These systems help mitigate peak grid charges, reduce demand penalties, and strengthen resilience.

Indoor Environmental Quality (IEQ) & Occupant Health

Sustainability isn’t just about energy it’s also about creating healthy spaces. Monitoring and controlling air quality (CO₂, VOCs, particulate matter), temperature, humidity, and daylight improve occupant productivity, satisfaction, and well-being. Smart systems can adjust ventilation rates or filtration based on real-time sensor readings.

Especially post-pandemic, tenants demand healthier environments. Buildings that deliver superior IEQ can command premium rents or retention.

Analytics, Benchmarking & ESG Reporting

To prove that your building is “green,” you need metrics. Analytics platforms aggregate data, generate energy and resource KPIs, and benchmark performance over time or against peer sets. They also produce reports for ESG frameworks and investor disclosures.

Without these measurement systems, a building risks being green in name only. The transparency and accountability are what convert sustainability into trust and capital access.

Real Product Examples That Support Sustainable Real Estate

Below are five real-world products or solutions that building owners, developers, or consultants can integrate into sustainable real estate projects. Each example includes its features, benefits, use cases, and guidance on how to acquire or evaluate.

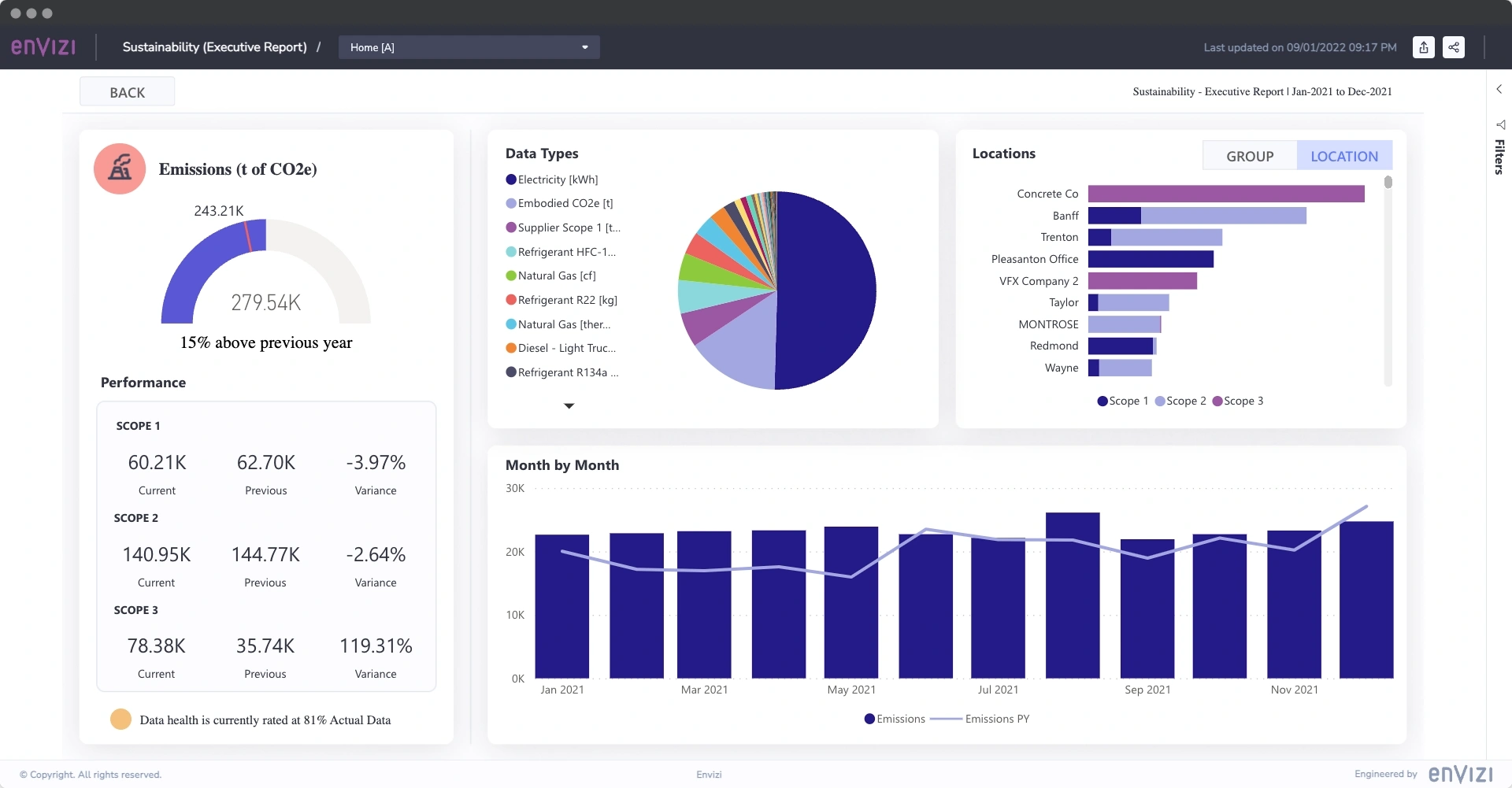

Envizi Sustainability Platform

Product Overview & Features

Envizi is a leading software platform that aggregates, normalizes, and analyzes sustainability and operational data—energy, water, emissions, waste, certifications, and ESG. It can interface with building systems, utility bills, IoT sensors, and more.

Key features:

-

Data ingestion connectors for multiple sources

-

Data quality checking and anomaly detection

-

Dashboarding and KPI tracking

-

Benchmarking and peer analysis

-

ESG and sustainability report generation

Detailed Benefits

By centralizing data, Envizi reduces manual consolidation and error risk. Building owners can monitor performance trends, identify underperformers, spot anomalies, and derive insight for retrofits. Because many ESG frameworks require verifiable data, having a platform like Envizi strengthens reporting credibility.

Use Case & Problem Solved

A real estate fund with dozens of assets in different cities struggles to collate utility bills, sensor logs, and audit data into a single KPI dashboard. Deploying Envizi helps standardize input, alert on missing or inconsistent data, and generate reporting outputs. This saves staff time, reduces validation risk, and helps the fund track sustainability progress across its portfolio.

How to Buy / Where to Buy

Envizi typically operates on a subscription (SaaS) model. You can request a demo on their website and negotiate based on number of properties, data connectors, and features.

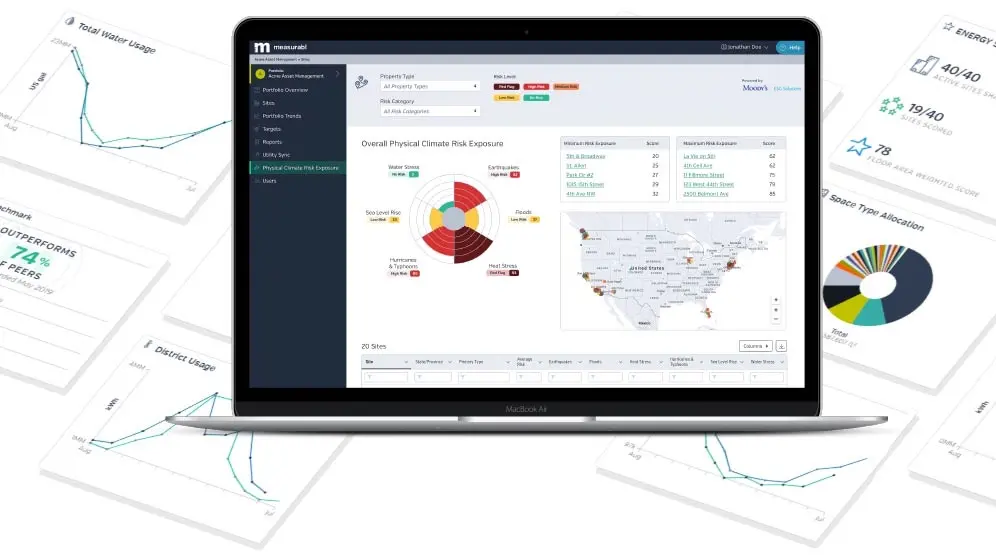

Measurabl ESG Platform

Product Overview & Features

Measurabl is a cloud-based ESG platform built for real estate. It supports automated data ingestion, benchmarking, sustainability scorecards, and export templates that align with investor and benchmark frameworks.

Features:

-

Connectivity to property management systems, metering, and sensor devices

-

GRESB and other reporting alignment

-

Benchmark reports and peer comparisons

-

Alerting for gaps or missing data

Detailed Benefits

With Measurabl, property managers dramatically reduce time spent formatting or mapping spreadsheets. Because it’s built for real estate, many template outputs match industry benchmark requirements (like GRESB). The platform also surfaces lagging assets or metric deviations that may require intervention.

Use Case & Problem Solved

A commercial office portfolio aims to improve its sustainability grade. Managers integrate Measurabl, feed energy and water data, and generate a baseline ESG score. They then track performance annually, and use the tool’s benchmarking to prioritize retrofit decisions for underperforming assets.

How to Buy / Where to Buy

You can contact Measurabl via their website to request a demo or subscription pricing. They typically tier pricing by portfolio size and connectors.

Accutrack IoT Sensor Systems

Product Overview & Features

Accutrack provides IoT hardware sensors for buildings measuring temperature, humidity, occupancy, power draw, airflow, and more. These can feed into BMS or analytics platforms.

Features:

-

Low-power wireless sensors

-

Real-time data streaming

-

Compatibility with standard IoT/BMS protocols

-

Battery or mains-powered options

Detailed Benefits

A building without detailed submetering or sub-system visibility cannot optimize. Deploying sensors in HVAC zones, lighting, or plug loads gives fine-grained insight. These sensors help detect inefficiencies, drift, or faults which degrade performance over time.

Use Case & Problem Solved

An existing office tower lacks visibility into lighting circuits and plug loads. The operations team installs Accutrack sensors across zones. Over weeks they capture usage patterns, detect “phantom loads,” and reprogram controls to reduce waste lowering energy consumption and improving ROI on upgrades.

How to Buy / Where to Buy

You can reach Accutrack Systems’ sales or distributor channels. Ask for a site survey and sensor count estimate.

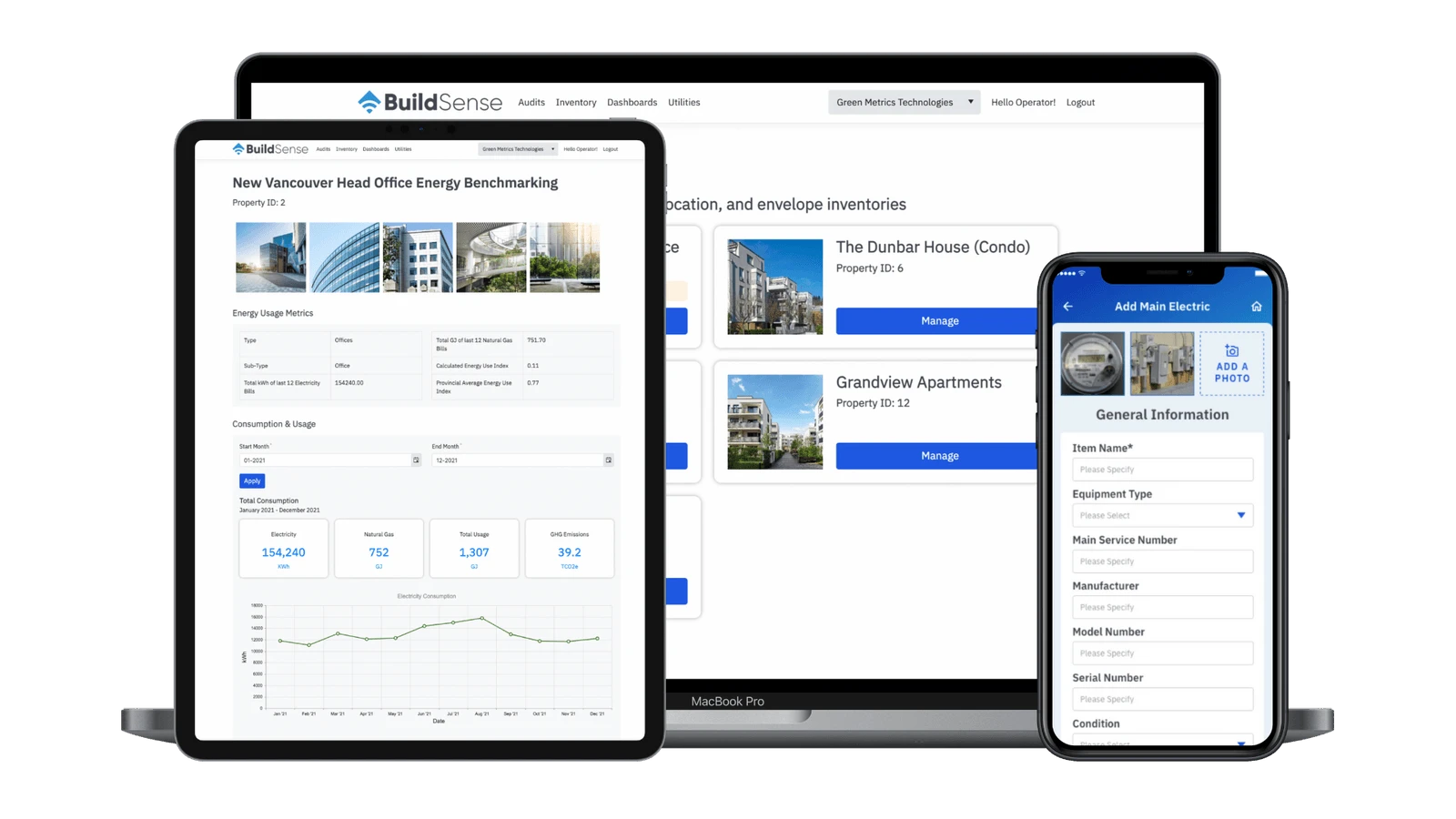

BuildingSense Analytics

Product Overview & Features

BuildingSense is a platform that applies machine learning and AI to building operational data to detect inefficiencies, equipment faults, and optimization opportunities.

Features:

-

Fault detection and diagnostics

-

Predictive maintenance alerts

-

Recommendations for control tuning or retrofit

-

Energy performance modeling

Detailed Benefits

While sensors and BMS provide raw data, BuildingSense transforms that into actionable insight. It flags anomalies (e.g. HVAC drift, pump inefficiency), provides root cause suggestions, and ranks opportunities by savings potential.

Use Case & Problem Solved

A property manager notices gradually rising utility bills but can’t pinpoint the cause. BuildingSense alerts reveal that a chiller is operating inefficiently overnight due to incorrect sequencing. Following the recommended intervention reduces load and pulls energy usage back in line.

How to Buy / Where to Buy

Contact BuildingSense sales via their site. Provide building size, connectivity, and existing data sources for scope and pricing.

Urbint Risk & Resilience Platform

Product Overview & Features

Urbint (or similar resilience modeling tools) provide climate risk modeling, hazard forecasting, and strategic resilience planning for buildings and infrastructure.

Features:

-

Climate stress scenario modeling (flood, storm, heat)

-

Asset-level exposure quantification

-

Mitigation strategy suggestion

-

Integration with ESG disclosure

Detailed Benefits

Sustainability is incomplete without resilience. Modeling how extreme weather affects your assets helps prioritize mitigation (flood barriers, backup power, envelope hardening). That data can then be disclosed for ESG or investor reports.

Use Case & Problem Solved

A coastal real estate portfolio is exposed to sea-level rise and storm surges. Using Urbint, the owner models various climate futures, quantifies financial risk, and decides which assets to retrofit. They include that information in investor materials to show proactive risk management.

How to Buy / Where to Buy

Request a demo or engage with Urbint or similar vendors. Provide geographic data and asset lists for modeling scope.

Benefits of Deploying These Products in Sustainable Real Estate

Integrating the products above into real estate operations yields multiple tangible benefits. Below is a breakdown of advantages:

Operational Cost Reductions & Efficiency Gains

Through sensor-driven automation, fault detection, and predictive maintenance, buildings can eliminate waste, optimize systems, and reduce energy, water, and maintenance costs. These savings often pay back product and installation costs within a few years.

Stronger Asset Valuation & Market Differentiation

“Green” or technologically advanced buildings attract premium tenants and more stable leases. Investors reward demonstrable sustainability with better valuations or lower financing costs.

ESG Reporting, Transparency & Capital Access

Institutional investors often require ESG disclosures. Platforms like Envizi or Measurabl help generate credible, benchmarked performance data, enhancing transparency and building trust with capital partners.

Risk Reduction & Resilience

Climate changes, energy price volatility, and regulation pose rising risk. Resilience planning and diagnostics reduce downside surprises. Buildings that anticipate stress are less likely to become stranded.

Tenant Health, Satisfaction & Retention

Better environmental quality increases occupant well-being and productivity, reducing turnover and vacancy. In competitive markets, a healthier building can command rent premiums.

Use Cases: How Real Estate & Sustainability Products Solve Problems

Use Case 1: Retrofitting an Aging Office Tower

An older office building has outdated HVAC, no submetering, and high energy bills. Tenant complaints about comfort are rising.

Solution:

-

Deploy IoT sensors (e.g., Accutrack) across HVAC zones, lighting circuits, and plug loads.

-

Feed data into analytics (BuildingSense).

-

Identify inefficiencies (e.g. poorly controlled zones, equipment drift).

-

Implement targeted retrofits (controls upgrades, variable speed drives).

-

Use a reporting platform (Envizi) to measure before/after KPIs.

Why it matters:

This approach targets the worst inefficiencies first, controls CAPEX, and demonstrates measurable ROI. It also enhances tenant comfort and strengthens lease renewals.

Use Case 2: New Development Aiming for ESG Premium

A developer is constructing a mixed-use building and wants to market it as a high-performance “green” property.

Solution:

-

Begin with passive, high-performance architecture (good envelope, insulation, orientation).

-

Specify integrated smart building infrastructure (wiring, sensors, analytics) from the start.

-

Provision roof PV + battery systems.

-

Engage a resilience modeling tool (Urbint) to stress-test climate exposure.

-

Use Measurabl or Envizi to map expected sustainability performance and include ESG metrics in brokerage materials.

Why it matters:

Buyers or tenants will see the lower operating costs and credibility of ESG assurances. The building is future-proofed and easier to finance or sell.

Use Case 3: Portfolio-Level ESG Benchmarking & Performance

A real estate fund with assets across cities struggles to standardize sustainability reporting.

Solution:

-

Deploy a sustainability platform (Envizi or Measurabl) with connectors to all assets.

-

Normalize data, run peer benchmarking, and highlight lagging properties.

-

Use analytics to guide capex allocations across assets (which to upgrade).

-

Generate investor-facing ESG dashboards and reports.

Why it matters:

The fund can demonstrate consistent ESG performance, better negotiate with investors, and justify capital decisions across its portfolio.

Use Case 4: Climate Risk Mitigation for Coastal Properties

A coastal property faces rising flood risk, storm surges, and wind events.

Solution:

-

Use Urbint to simulate climate stress scenarios and asset-level exposure.

-

Prioritize mitigations (enhanced drainage, elevation, flood barriers, envelope resilience).

-

Monitor energy usage or backup system readiness.

-

Report mitigation plans in ESG disclosures to investors or insurers.

Why it matters:

This proactive stance reduces risk, avoids surprises, and enhances confidence among stakeholders that the assets are not vulnerable.

How to Procure & Buy These Solutions

Steps to Buy / Procure

-

Define scope & metrics – Determine asset counts, data sources, performance goals, ESG expectations.

-

Request demonstrations – Use vendor websites (Envizi, Measurabl, Accutrack, BuildingSense, Urbint) to schedule demos or pilot installations.

-

Run pilot projects – Pilot a small building or floor to test integration, data collection, and insights.

-

Scale roll-out – Based on pilot results, expand across your portfolio.

-

Negotiate contracts – Seek subscription or licensing models based on scale, connectors, support.

-

Integration & training – Ensure teams understand dashboards, alerts, and remediation workflows.

-

Measure & iterate – Review baseline vs post-implementation KPIs; fine-tune systems over time.

Pricing & Licensing Models

-

Most platforms (Envizi, Measurabl) offer SaaS subscription pricing based on number of assets, data connectors, feature tiers, and user seats.

-

IoT sensor hardware is typically purchased or leased; you will also need gateways, network infrastructure, and installation costs.

-

Analytics platforms (BuildingSense) may have license plus per-asset fees or usage models.

-

Resilience modeling tools (Urbint) often charge per asset or region modeled.

Where to Buy / Contact

-

Vendor websites (Envizi, Measurabl, etc.) typically provide demo request and contact forms.

-

System integrators or sustainability consultancies can act as procurement and implementation partners.

-

Local distributors or IoT hardware resellers may supply sensor systems (for Accutrack or similar brands).

-

Some organizations bundle these solutions with green building consults or retrofit packages.

Tips to Maximize ROI & SEO Value

-

Start with pilot buildings to validate assumptions before full rollout.

-

Tie sustainability key performance indicators (KPIs) to executive incentives so sustainability becomes embedded.

-

Use benchmarking to set annual improvement targets.

-

Integrate systems (IoT → analytics → asset management) so insights feed back into decision-making.

-

Document all upgrades, calibration logs, and audit trails to support ESG reporting.

-

Stay current with evolving ESG disclosure frameworks (e.g. CSRD, TCFD) and align your data platform accordingly.

-

Market your sustainable credentials publish case studies, ESG summaries, or tenant benefit stories to attract capital or tenants.

Frequently Asked Questions

Q1: Are sustainable real estate technologies expensive, and is payback realistic?

Costs can be significant initially, especially hardware and integration, but many deployments achieve payback within 3 to 7 years via energy, water, and maintenance savings. Plus, the increased asset valuation, investor appeal, and lower risk can compound the return.

Q2: How do I integrate new technology into existing, legacy buildings?

Many systems support retrofit deployment. Wireless sensors, edge gateways, and flexible connectors allow you to overlay monitoring even in older buildings. Pilots help validate integration. Cost, wiring, and compatibility are key considerations, so phased deployment is often wiser.

Q3: Which product should I choose first for a sustainable real estate project?

Start with data: deploy sensors and analytics so you understand your baseline. Without measurement, other steps are guesswork. After that, focus on controls upgrades, renewable integration, and resilience. Always build out from data insight.

By combining real estate and sustainability via reliable technologies and evidence-based strategies, property owners can transform buildings from liabilities into resilient, value-generating assets. The products and approaches outlined above provide a roadmap usable today for delivering sustainable real estate that appeals to tenants, regulators, investors, and the planet.