GRESB Global Real Estate Sustainability Benchmark: How to Leverage It for Asset Value & ESG Excellence

Why the GRESB Benchmark Is Critical for Real Estate Investors & Operators

Unlocking Investor Confidence & Capital

Institutional investors increasingly demand ESG transparency. Many now require benchmarked ESG metrics before allocating capital. GRESB acts as a trusted, third-party framework that lets investors compare like with like across markets, sectors, and geographies.

When your fund or property portfolio reports via GRESB, you demonstrate you track critical sustainability metrics energy, water, waste, greenhouse gas emissions, stakeholder engagement, risk strategies using validated, standardized data. That often leads to easier due diligence, stronger investor trust, and improved deal flow.

Benchmarking & Identifying Performance Gaps

One of GRESB’s most valuable features is benchmarking against peer groups. Your portfolio’s score is not just absolute but relative. You can see where you outperform or lag on each ESG indicator.

This level of granularity is invaluable. For example, your buildings might perform well on energy but poorly on water usage or waste management. With GRESB’s reporting, you can pinpoint where ESG investments deliver the greatest marginal improvement.

Encouraging Continuous Improvement

GRESB is not a one-time check. Every year, new assessments are submitted, scores are updated, and participants track trends over time. This encourages gradual improvements in efficiency, occupant well-being, and resilience to climate risk.

As ESG standards evolve (e.g., new climate disclosures, carbon targets, stakeholder expectations), GRESB updates its methodology, pushing participants to stay current.

Strengthening Risk Management & Regulatory Readiness

Climate and environmental risks are increasingly material to real estate. Exposure to energy scarcity, water stress, extreme weather, and carbon regulation can damage property values. GRESB prompts participants to proactively assess and manage those risks.

Moreover, various jurisdictions now demand ESG disclosures (e.g., TCFD, EU’s CSRD, climate stress testing). GRESB provides a baseline framework aligning with common standards, giving participants a head start in regulatory compliance.

How GRESB Benchmarking Works: Key Components & Scoring

The GRESB Real Estate Assessment is structured into components, indicators, scoring, and validation.

Components & Indicators

The assessment divides ESG into segments:

-

Management: leadership, policies, strategy, risk, stakeholder engagement

-

Performance: operational outcomes like energy, emissions, water, waste, certifications

-

Development: for projects sustainable design, materials, impact, innovation

Each of these categories is broken into detailed indicators with explicit reporting requirements.

Scoring & Benchmarking

Participants receive a GRESB Score (0–100) based on weighted indicator performance. That raw score is then converted into a star-based GRESB Rating, where performance quintiles map to 1–5 stars.

Alongside, participants receive a Benchmark Report which shows how the portfolio compares against peers on each indicator, trend data, and gap analysis.

Validation & Quality Control

GRESB includes multi-stage validation of the submitted data to ensure reliability. Errors, anomalies, or missing data can flag deductions or required clarifications.

Participants may also purchase a Response Check service, which reviews their submissions and helps resolve validation queries.

Real-World Examples: ESG Tools & Products That Support GRESB Performance

To meet GRESB requirements and improve scores, many real estate managers adopt ESG and sustainability tools, software, and devices. Below are five real-world solutions that integrate well with the GRESB benchmarking framework. Each one helps solve particular pain points in data collection, measurement, or operational efficiency.

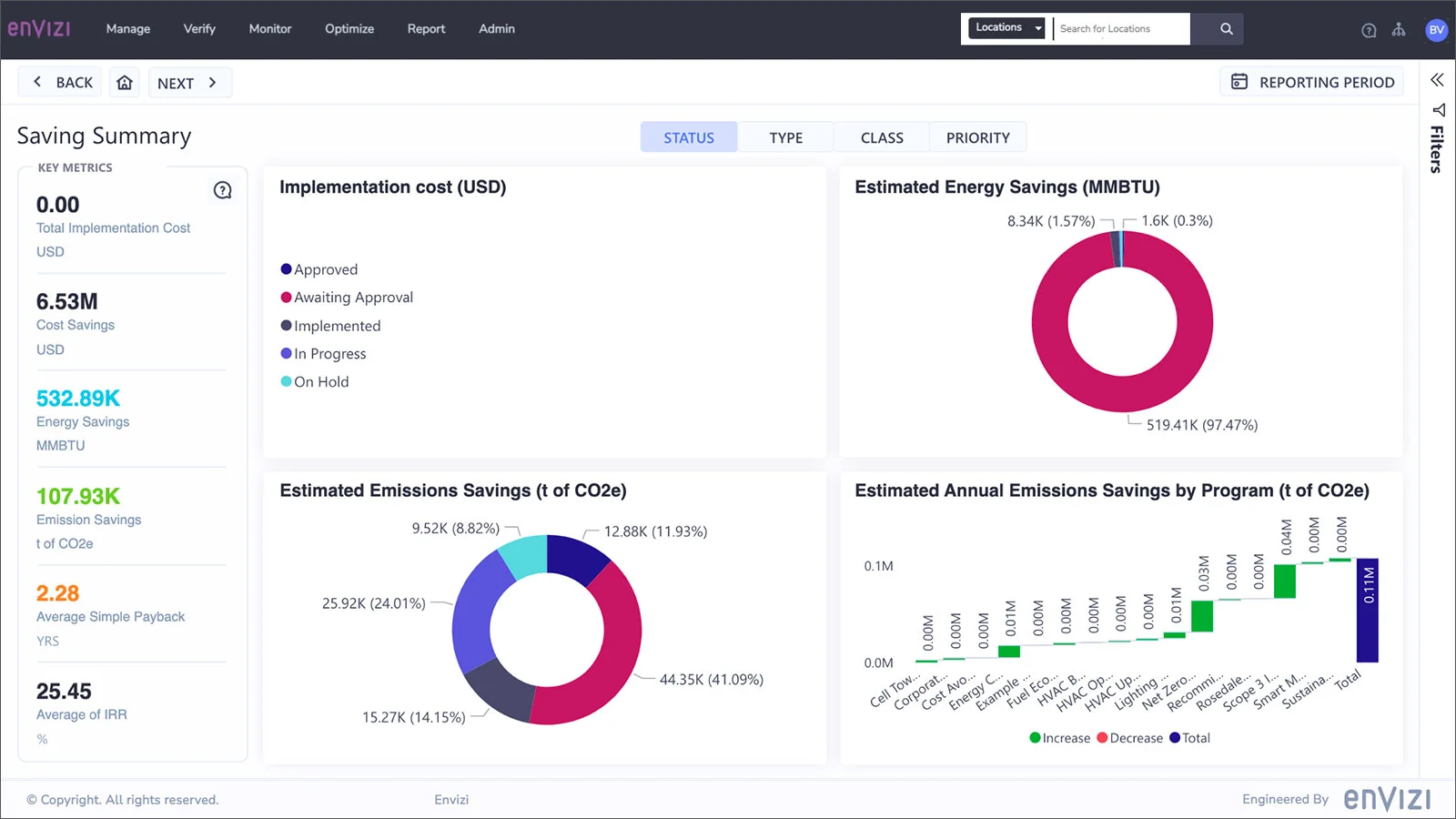

Envizi Sustainability Software

Envizi is a global sustainability data platform that aggregates, analyzes, and reports on energy, emissions, water, waste, and other ESG metrics. Because GRESB requires detailed asset-level reporting, Envizi helps by centralizing disparate building systems into a unified dashboard aligned with GRESB’s indicator structure.

Detail & use case:

-

Collects meter, sensor, and utility data automatically across properties

-

Supports data quality checks, gap analysis, and estimation logic to satisfy GRESB validation

-

Enables historical trend tracking and benchmarking for internal improvement

Problem solved: Without such a system, data is often siloed, manually aggregated, and error-prone. Envizi cuts down on staff time, reduces validation risk, and accelerates GRESB submission readiness.

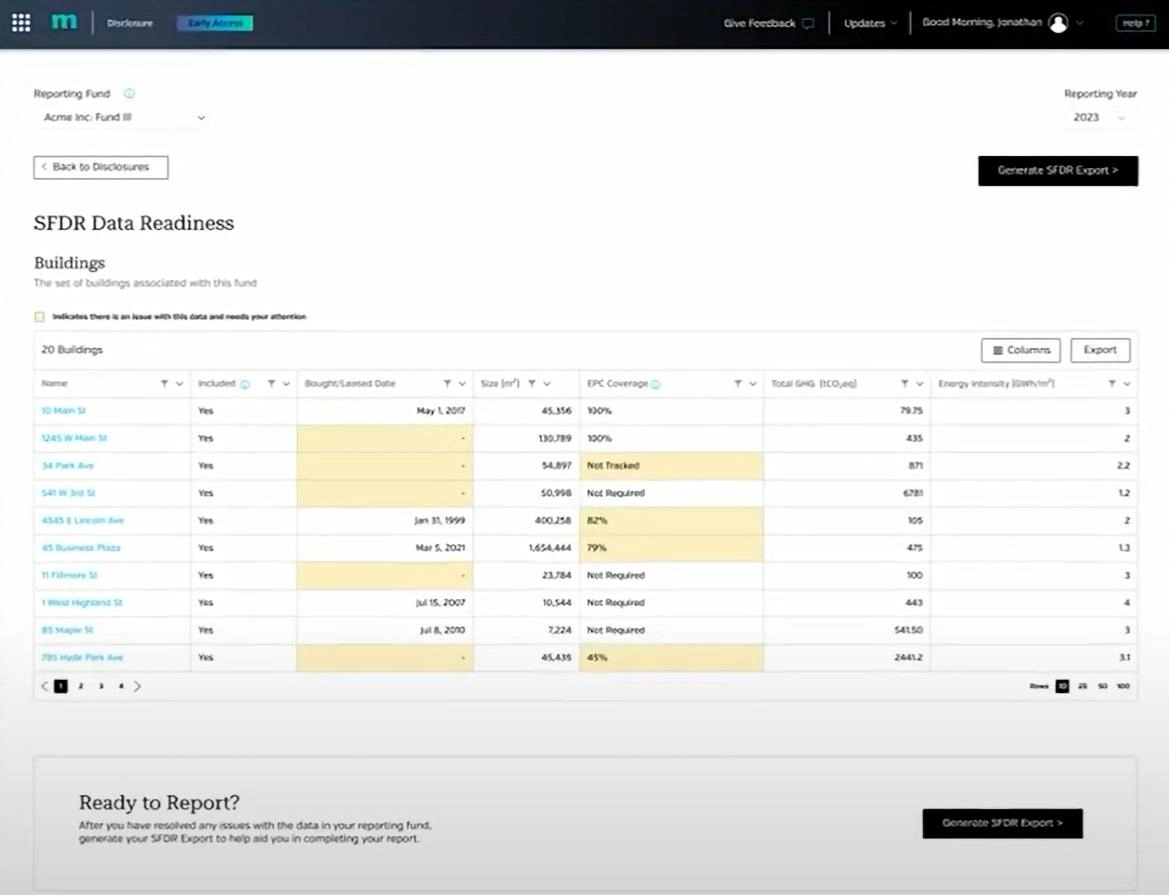

Measurabl ESG Platform

Measurabl offers a cloud ESG platform optimized for real estate portfolios. It supports automated data ingestion, benchmarking, and alignment with GRESB reporting protocols.

Detail & use case:

-

Integrates with property management systems, IoT sensors, and utility APIs

-

Generates GRESB-ready export templates

-

Provides benchmarking and analytics to spot performance lag across assets

Problem solved: Many real estate firms struggle with consolidating ESG data across assets. Measurabl provides a scalable, real-estate-specific wrapper around GRESB reporting.

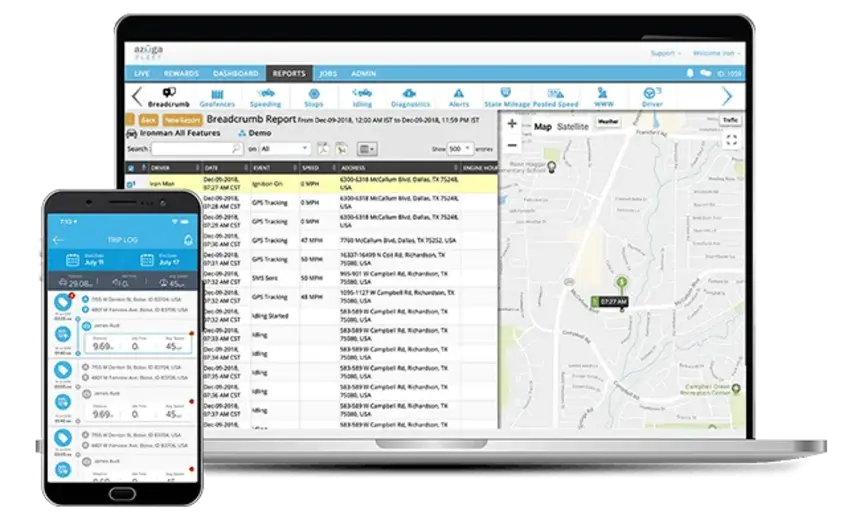

Accutrack IoT Sensors

Accutrack manufactures IoT sensor devices for monitoring environmental conditions—such as temperature, humidity, power consumption at granular levels.

Detail & use case:

-

IoT sensors placed in HVAC systems, lighting circuits, plug loads

-

Real-time streams into a central platform

-

Helps track anomalies, verify energy conservation, and validate reported data

Problem solved: Many properties lack continuous monitoring of subsystems. These sensors fill visibility gaps that can help validate or challenge estimation assumptions under GRESB.

BuildingSense Analytics

BuildingSense is an analytics engine that applies AI to operational building data to detect inefficiencies, faults, and opportunities for energy & water optimizations.

Detail & use case:

-

Detects equipment faults (e.g., HVAC drift, pump inefficiency)

-

Recommends corrective maintenance or retrofits that improve consumption

-

Provides reporting on improvements, which feeds into better GRESB indicator scores

Problem solved: GRESB rewards not just data, but demonstrated performance. BuildingSense helps improve performance over time, closing gaps on underperforming indicators.

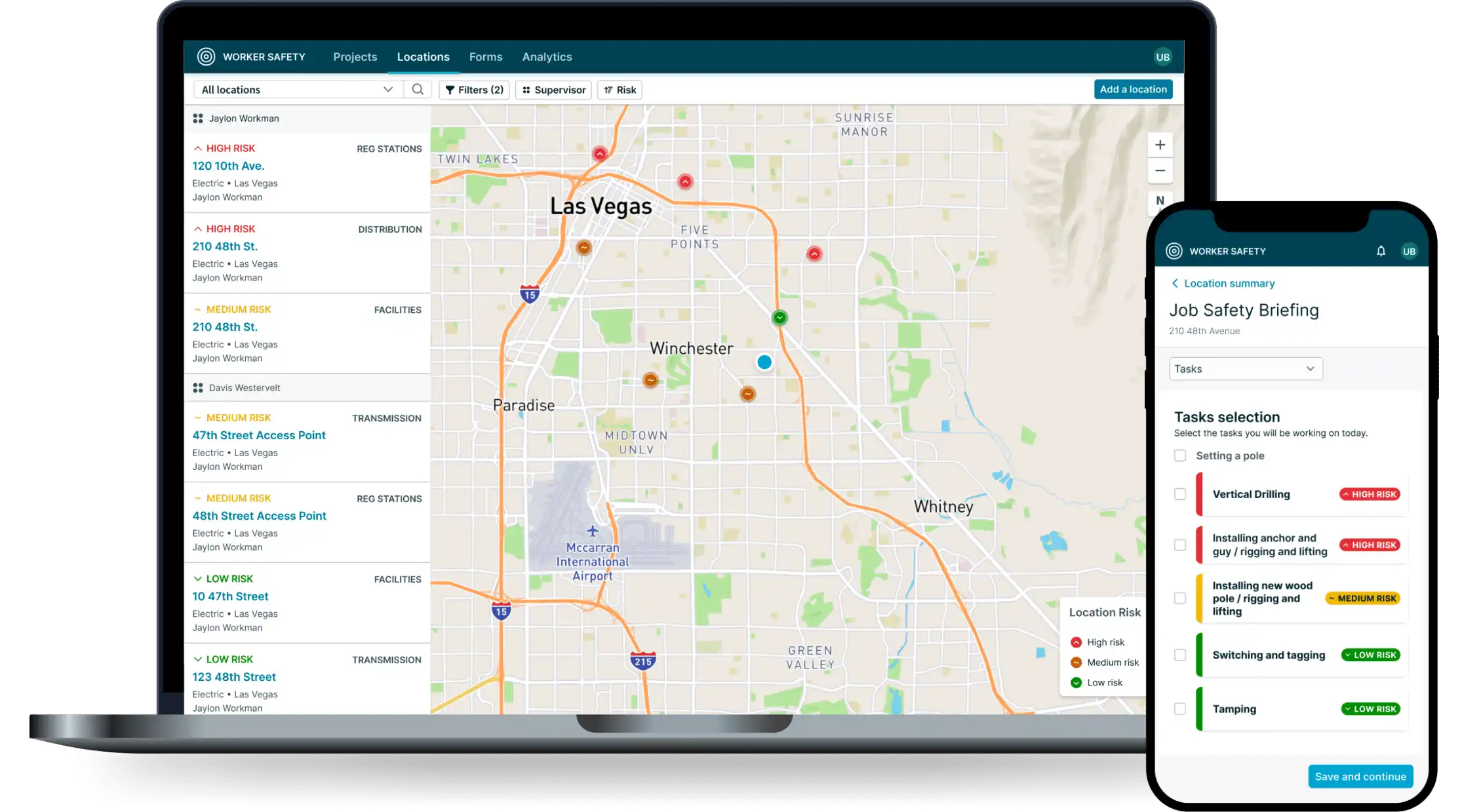

Urbint Risk & Resilience

Urbint provides risk and resilience modeling, including climate risk scenario assessments, which align with GRESB’s increasing focus on resilience and climate adaptation.

Detail & use case:

-

Projects climate stress (flood, heat, storm) on physical assets

-

Provides actionable mitigation strategies

-

Quantifies risk in financial and ESG terms, enabling inclusion in GRESB disclosure

Problem solved: Many real estate portfolios lack structured climate risk analysis. With increasing regulatory and investor pressure, portfolios without resilience plans can suffer valuation loss or poor GRESB scores.

Benefits of Using ESG Tools for GRESB Performance

Better Data Integrity and Efficiency

Automated platforms reduce manual errors, ensure consistent unit formats, and maintain versioning—making validation smoother.

Faster Time to Submission

Because these tools often support GRESB submission templates natively, participants spend less time mapping, cleaning, or reworking data at the last minute.

Performance Improvement Over Time

Analytics, alerts, and benchmarking features help asset operators systematically uncover inefficiencies, implement corrective measures, and track improvement converting data into action.

Competitive Advantage in Capital Markets

Portfolios that show steady ESG progress and top-tier GRESB scores become preferred partners in capital sourcing, joint ventures, or disposition strategies.

Regulatory & Disclosure Alignment

Many ESG frameworks (TCFD, SFDR, national climate rules) share overlap with GRESB indicators. A consolidated platform eases compliance across multiple reporting regimes.

Use Cases: Problems Solved by GRESB & Its Supporting Tools

Use Case 1: Multi-Asset Portfolio with Fragmented Data

Problem: A real estate fund holds dozens of assets across cities. Utility records, sensor data, and certifications are tracked in disparate systems and spreadsheets.

Solution via GRESB + platform: Use a unified ESG platform (like Envizi or Measurabl) to ingest and standardize data. Map assets into GRESB peer categories. Submit the GRESB assessment with confidence. Post-assessment, use benchmarking to detect underperformers and target retrofits accordingly.

Why necessary: Without standardization, manual aggregation causes downtime, data mismatch, and validation issues. GRESB forces clarity and consistency.

Use Case 2: New Development Project Seeking ESG Premium

Problem: A developer plans an eco-certified office complex and wants to attract ESG-conscious tenants and capital.

Solution via GRESB: Use the GRESB Development Benchmark to project ESG performance during design and construction. Leverage tools like BuildingSense or Urbint to simulate energy/water/resilience metrics. During operations, submit under GRESB standing metrics to prove performance.

Why necessary: GRESB’s Development Benchmark enables credibly comparing project-level ESG commitments across peer builds. It differentiates you during leasing and investment rounds.

Use Case 3: Risk Management for Climate Exposure

Problem: A coastal property portfolio faces flood risk, increased storm frequency, and regulatory shift toward carbon pricing.

Solution via GRESB + Urbint: Use climate risk modeling to forecast exposure. Include mitigation (e.g., flood controls, backup power). Report mitigation and resilience measures via GRESB indicators. Demonstrate to investors and insurers that your portfolio is climate-resilient.

Why necessary: GRESB’s evolving structure increasingly rewards resilience planning. Without climate risk disclosure, assets may draw down value in future markets.

Use Case 4: Asset Disposal / Acquisition Due Diligence

Problem: In acquisitions, investors want ESG metrics for target assets beyond financials.

Solution via GRESB: Require sellers to complete GRESB or facilitate a retroactive partial submission. Use benchmarking to compare to other assets. As acquirer, integrate the portfolio into your GRESB reporting and grab quick wins via analytics.

Why necessary: ESG transparency becomes a due diligence standard. Without it, buyers may undervalue or bypass deals.

How to Participate in GRESB: Steps, Cost & Buying Workflow

Steps to Participate

-

Register on the GRESB Portal – Entities apply to become a GRESB participant.

-

Collect ESG Input Data – Gather policies, audit reports, utility metrics, certifications, climate risk assessments, stakeholder disclosures.

-

Map to GRESB Indicators – Use reference guides to ensure each asset is assigned correct peer group, sector, region, and metrics.

-

Submit via Portal (April 1 – July 1 window) – Late or incomplete submissions may incur penalties.

-

Validation & Response – GRESB may request clarifications. There’s optional response review.

-

Receive Benchmark Report – You get comparative reports, scores, peer benchmarking, and guidance on improvement.

-

Iterate & Improve – Use insights to retro-optimize underperforming assets and re-submit next year.

Cost & Licensing

GRESB fees depend on entity size, geographical region, and whether you desire full Benchmark Reports or supplementary services. There is generally an assessment participation fee plus optional add-ons (Response Check, deeper analytics).

The ESG tools (Envizi, Measurabl, etc.) usually function on SaaS subscription models, often tiered by asset count, data ingestion volume, and feature set. These are not GRESB products per se, but complementary commercial offerings.

Where to Buy / Subscribe

-

GRESB Portal / Official Website – registration and official documents are directly via GRESB’s site.

-

ESG Platform Providers – visit product websites (Envizi, Measurabl, etc.) and request demo or subscription quotes.

-

Consultants / Advisory Firms – many sustainability consultancies assist with GRESB submission, data alignment, validation, and improvement strategy.

Tips to Maximize Your GRESB Score & Return on Investment

-

Start early: Don’t wait until the submission window. Begin data work months in advance.

-

Align internal metrics: Tie internal KPIs (energy goals, occupant satisfaction) to GRESB indicators so your operational goals feed your reporting.

-

Prioritize high-impact assets: Focus retrofits or upgrades on underperforming, high-leverage assets first.

-

Benchmark by region/sector: Make sure your peer groups are accurate; misclassification can penalize your relative score.

-

Document everything: Keep audit trails, calibration records, QA logs validation wants evidence.

-

Iterate year to year: Small annual gains help you climb peer quartiles rather than chasing a giant one-time jump.

-

Engage tenants & stakeholders: Many social / governance metrics depend on stakeholder communication, ESG policies, tenant programs.

-

Plan for resilience: Incorporate climate adaptation measures flood mitigation, backup systems, passive cooling as these metrics are gaining weight.

Common Criticisms & What to Watch Out For

Some critics point out that GRESB relies on self-reported data, which may be vulnerable to “greenwashing.” The validation mechanisms help mitigate this, but participants must remain rigorous in data quality.

Also, because GRESB weights change annually, optimizing for one year’s criteria may backfire in future cycles. Participants must stay adaptable.

Finally, participation costs and software investments can be high, particularly for smaller or regional portfolios. But many consider this as a strategic investment into credibility, access to capital, and future-proofing.

Frequently Asked Questions

Q1: Is GRESB certification the same as a green building certification (like LEED)?

No. GRESB is not a building-level certification. Rather, it’s an ESG benchmarking system at portfolio or asset level. LEED, BREEAM, or other green building ratings certify individual buildings on design or operational standards. GRESB may incorporate or reference those certifications as indicators within its data framework.

Q2: Can small or regional real estate portfolios participate in GRESB?

Yes. GRESB accepts both listed and non-listed entities, large and small. The key is whether you can assemble the required ESG data and align to peer categories. Many smaller firms partner with consultants or ESG platform vendors to make participation feasible.

Q3: How long does it take to see a return on investment after adopting GRESB and ESG tools?

It depends on scale, baseline performance, and capital available for improvements. You may see reputational and investor benefits within 1 year. Operational savings (energy, water) often accrue over 2–5 years. Some capital markets advantages (better terms, premium pricing) may take multiple cycles as your ESG track record builds.

Using the GRESB Global Real Estate Sustainability Benchmark is more than just reporting it’s a pathway to ESG leadership, operational efficiency, risk mitigation, and capital access. With the right tools, strategy, and discipline, real estate investors and operators can turn sustainability from compliance into competitive advantage.