Green Bond Financed Housing Developments: How to Access, Structure & Invest

What Are Green Bond Financed Housing Developments?

Green bonds are debt instruments whose proceeds are earmarked exclusively for projects with clear environmental benefits—energy efficiency, renewable energy, sustainable water, green building, and more.

When those proceeds are directed toward housing developments, you get green bond financed housing developments projects where the capital raised is used (or refinanced) to build or retrofit homes meeting sustainability criteria.

These developments often comply with green building standards (LEED, EDGE, BREEAM, etc.) or local low-carbon building schemes, incorporate renewable energy, efficient HVAC, water reuse, sustainable materials, and sometimes resilience/climate adaptation features.

Such structures marry finance and sustainable real estate, enabling developers to access capital from ESG-minded investors, while delivering homes with lower operational costs and environmental impact.

Why Green Bond Financing for Housing Developments Matters

Green bond financing brings a number of compelling advantages for developers, investors, and communities alike.

Access to Capital from ESG & Institutional Investors

Investors are increasingly allocating capital to sustainable assets. Green bonds allow developers to tap into dedicated pools of “green capital” that prefer or require ESG alignment. Many institutions now set quotas for green or sustainable investments.

Issuing a green bond or structuring a green financing reduces the risk of investor pushback by clearly pledging how proceeds will be used. This transparency often helps attract larger or more favorable commitments.

Cost Efficiency, Reputation & Market Differentiation

Because green bond issuance signals rigorous environmental credentials and accountability, developers can enhance reputation, branding, and market positioning. For buyers, being able to live in “green bond backed” housing can be a marketing differentiator.

Some jurisdictions also provide incentives tax credits, subsidies, lower rates for green buildings, which further improve the financial case.

Moreover, lower operating costs (energy, water) in sustainable housing create more attractive value propositions for residents and reduce default risk over time.

How to Structure a Green Bond for Housing Development

Designing a green bond issuance for housing requires careful planning, compliance, and governance. Here’s a step-by-step overview:

Define Green Bond Framework & Eligible Criteria

To issue a green bond, the issuer must define a framework setting out how proceeds will be used, processes for evaluation and selection, management of proceeds, and reporting.

Within housing developments, eligible criteria may include:

-

Compliance with energy efficiency thresholds

-

Renewable energy or solar installations

-

Water reuse, greywater systems, rainwater capture

-

Sustainable materials or low-carbon construction

-

Resilience / climate adaptation features

Often the framework requires external review (second-party opinion) or verification to ensure green bond standards alignment.

Issue the Bond & Allocate Proceeds

Once the bond is structured and approved, it is issued in capital markets or private placements. The proceeds must be tracked and segregated (or earmarked) to eligible green housing projects.

If the bond finances multiple projects, the issuer should maintain an allocation register to ensure traceability.

Reporting & Impact Monitoring

Issuers must regularly report on how proceeds are used and the environmental impact achieved (e.g. energy saved, emissions avoided). Transparency builds investor trust and ensures ongoing eligibility.

Sometimes third-party verification or assurance is used to validate the reported impact.

Refinancing & Recapture Mechanisms

Some green housing developments may already exist. Green bonds can refinance existing assets that meet green criteria giving developers retroactive sustainability credentials. But the same rigor in allocation and reporting applies.

Real-World Examples of Green Bond Financed Housing Developments

Here are several real projects or initiatives where green bond or analogous sustainable finance has supported housing or residential development.

Example 1: Nedbank Green Bond for Residential Developments (South Africa)

In December 2021, Nedbank (anchored by IFC) issued a green bond specifically to fund green residential housing developments in South Africa.

This bond was aimed at expanding the portfolio of homes certified under IFC’s EDGE (Excellence in Design for Greater Efficiencies) programs encouraging resource-efficient, low-carbon houses in a region where housing demand is great and energy burden is high.

By anchoring the bond with IFC, Nedbank increased investor confidence, ensuring that proceeds would be channelled to certified sustainable homes.

Example 2: Vinte Sustainable / SDG Bonds (Mexico)

Mexican housing developer Vinte issued sustainability bonds (Mexican pesos) in 2018, with proceeds allocated to sustainable infrastructure and housing communities covering energy efficiency, water adaptation, and green standards.

They targeted “sustainable communities,” including measures in social housing, rainwater collection, water treatment, and EDGE or Zero Gas certification. Vinte’s bond issuance shows how developers in emerging markets can integrate green financing into affordable housing.

Example 3: Fannie Mae’s Green Bond–Backed Housing Programs (U.S.)

Fannie Mae has issued green bonds to support multifamily housing renovations or new construction. In 2023, its multifamily bond program raised $7.5 billion to support developing or upgrading 48,000 apartments.

These projects required energy and water performance improvements (e.g. 15%+ efficiency gains). This approach demonstrates how conventional mortgage institutions can embed green criteria into housing financing at scale.

Example 4: Prologis & Commercial Real Estate Green Bonds

Although not purely housing, Prologi one of the world’s largest industrial real estate firms has issued green bonds to finance its LEED / energy-efficient building portfolio.

The lessons from their approach—leveraging green bond investor appetite and tying sustainability into their real estate operations—are instructive for residential developers seeking scale.

Example 5: Low-Carbon Building Bonds in Latin America

In countries like Mexico, green bonds have partially funded low-carbon building assets within residential projects. For instance, developers like CADU aim to issue climate-certified green bonds targeting energy-efficient housing development.

Though many of these remain nascent, they signal the growing pipeline of demand for green bond-housing alignments.

Benefits & Challenges of Green Bond Financed Housing Developments

Benefits in Detail

-

Lower cost of capital (potentially): In some cases, green bond investors may accept slightly lower yields or favorable terms given the ESG premium.

-

Operational savings for residents: Energy and water reductions lower monthly utility costs, improving affordability and reducing default risk.

-

Enhanced investor confidence & portfolio diversification: Green bonds bring institutional ESG capital that sometimes is locked in or earmarked.

-

Regulatory alignment & incentives: Governments may offer tax incentives, subsidies, or fast-track approvals for sustainable developments.

-

Marketing and branding strength: Being “green bond backed” becomes a differentiator to buyers, tenants, and communities.

Major Challenges to Watch

-

Stringent eligibility & verification: Meeting green criteria, obtaining external opinions, and rigorous reporting add cost and complexity.

-

Risk of “greenwashing” backlash: If projects don’t deliver promised environmental outcomes, reputation damage is severe.

-

Higher upfront cost: Sustainable materials, renewable systems, and certification may raise capital cost initially.

-

Market appetite & liquidity: In some markets, the investor base for green bonds is smaller, which can limit deal scale or push up spreads.

-

Monitoring and ongoing compliance: Maintenance of performance thresholds over time is essential; failure can jeopardize green status.

Technology & “Product” Solutions That Enable Green Bond Housing Projects

While green bond financing is financial, executing a sustainable housing development still requires practical products, technologies, and systems. Here are five categories (and some real products/systems) commonly involved each described in actionable terms. (These are not bond products, but enabling solutions that make the development viable and credible.)

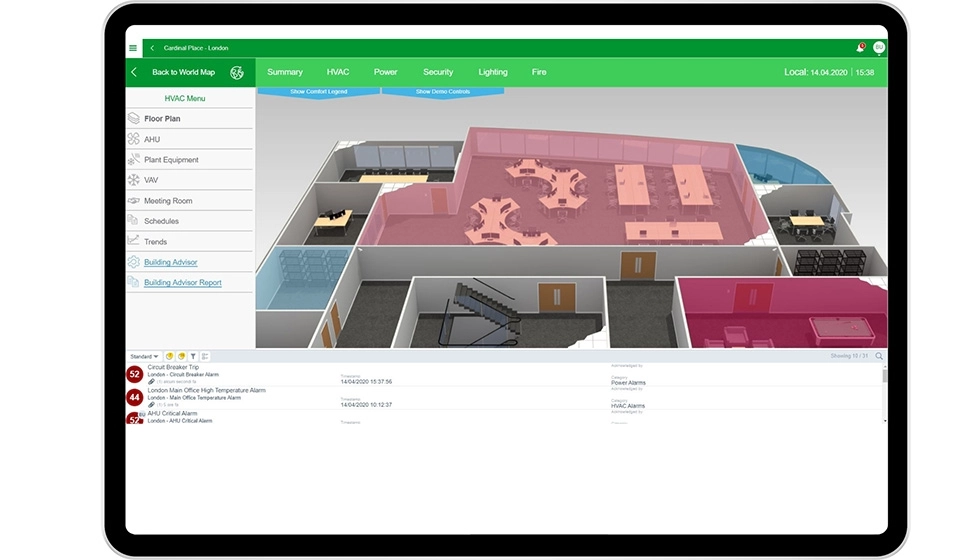

Schneider Electric EcoStruxure Building

Detail & Features

Schneider platform integrates building automation, energy management, IoT sensors, predictive analytics, and control across HVAC, lighting, power. It enables real-time monitoring and optimization.

Why Critical in Green Housing Projects

To meet energy performance thresholds demanded by green bond frameworks, buildings must continuously optimize operations. EcoStruxure helps manage and validate system performance, detect deviations, and support reporting.

Use Case

A residential complex financed via a green bond installs EcoStruxure so that every unit’s energy consumption is monitored, aggregated, and anomalies flagged. This data feeds into green bond reporting dashboards, demonstrating compliance over time.

How to Acquire

Contact Schneider Electric through their sales channels. Projects typically involve system integration, IoT sensors, and licensing.

Dell Edge Gateway / IoT Devices

Detail & Features

Edge gateways collect sensor data, preprocess it locally, and relay to cloud, reducing latency or network load. Useful in housing developments for submetering, environment sensors, etc.

Why Critical

A green bond financed housing project may require fine-grained data (floor energy, temperature, humidity, water). Edge gateways help capture that in a scalable way without large data infrastructure overhead.

Use Case

In each residential building block, Dell edge gateways handle dozens of sensor inputs, package the data, and send it to the developer’s cloud or analytics backend. It ensures data continuity and reliability for ongoing green bond compliance.

How to Acquire

Dell sells IoT gateways via enterprise division or reseller networks. You’ll need to specify count, connectivity, and integration needs.

JinkoSolar PV Panels

Detail & Features

High-efficiency photovoltaic (solar) panels for rooftop or façade integration. Jinko offers a range of modules and systems with robust performance.

Why Critical

Green housing developments often require on-site renewable energy to reduce fossil electricity consumption. Solar is a common lever to push projects into compliance with green criteria.

Use Case

The housing development includes rooftop solar arrays using Jinko modules sized to offset a portion of common-area electricity. The actual output is tracked, contributing to the green bond’s reported emissions avoidance metric.

How to Acquire

You can procure Jinko modules through solar distributors or installers. In many regions, EPC (engineering, procurement, construction) firms can handle package deals.

Vaillant Heat Pumps & HVAC Systems

Detail & Features

Vaillant High-efficiency heat pump units (air-source, ground-source) and HVAC systems, offering heating, cooling, and often integrated with renewable or smart control platforms.

Why Critical

To reduce emissions, green housing projects often replace gas boilers or fossil heating with heat pumps. Coupled with good envelope design, they help meet stringent energy thresholds.

Use Case

Each housing unit installs a Vaillant heat pump system, sized for local climate. Combined with insulation and smart controls, the building achieves energy reduction targets required by the green bond criteria.

How to Acquire

Vaillant sells via HVAC distributors, consultants, or directly in many markets. Request proposals including capacity, efficiency, and system integration.

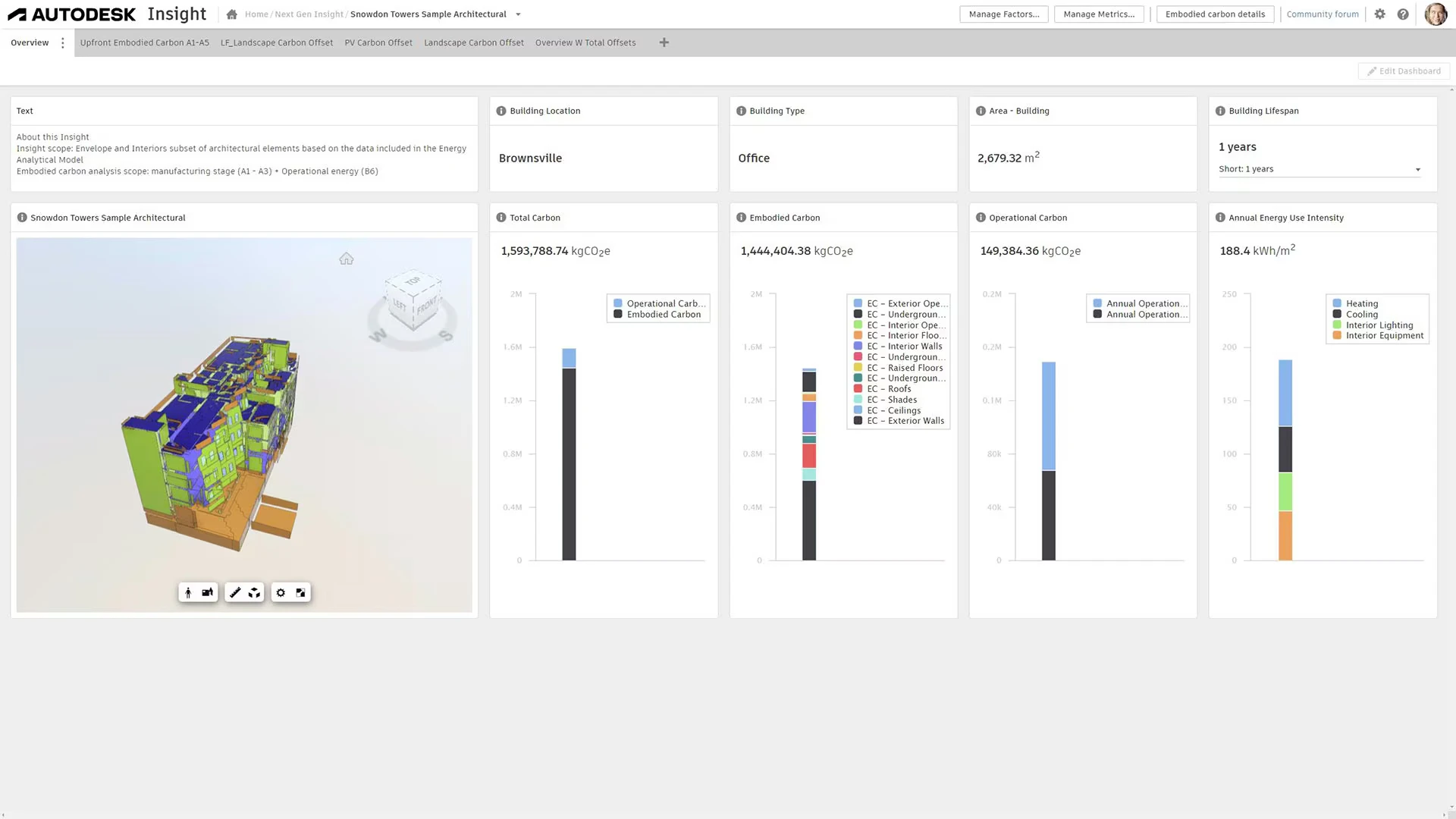

Autodesk Revit + Insight Analytics

Detail & Features

Autodesk Revit is a building information modeling (BIM) platform; Insight is its performance analytics add-on, enabling energy simulation, daylighting, thermal analysis, and optimization during design.

Why Critical

Green bond-backed housing needs to forecast performance and model compliance early. Using BIM + energy simulation ensures the design is viable and aligned with eligibility thresholds before breaking ground.

Use Case

The development team uses Revit + Insight to simulate multiple designs, optimize envelope, orientation, glazing, shading, HVAC loads, and verify that the project meets green criteria before issuing the bond.

How to Acquire

Autodesk licenses these products on subscription. Architects or developers can subscribe, train staff, and integrate into design workflow.

Use Cases: How Green Bond Financed Housing Developments Solve Real Problems

Use Case 1: Affordable Housing with Lower Utility Burden

Problem: Low-income households often struggle with high utility bills; conventional affordable housing may lack energy efficiency.

Solution: A developer issues a green bond to finance an affordable housing complex with high-efficiency envelope, solar, heat pumps, and water reuse. The lower operating costs reduce financial stress on tenants and improve long-term affordability.

Why necessary: It aligns social and environmental goals. Because the bond is green, investors are comfortable funding a project with positive ESG and social impact.

Use Case 2: Retrofit Existing Housing Stock

Problem: A city has aging apartment blocks with high energy waste and emissions but lacks capital to retrofit them.

Solution: The municipality or housing authority issues a green bond to retrofit these blocks insulation, efficient heating, smart controls, retrofitted windows. By converting old buildings into low-carbon homes, the city reduces emissions and improves living conditions.

Why necessary: Green financing unlocks capital for sustainability upgrades, which might otherwise be too costly for public budgets or conventional financing.

Use Case 3: Mixed-Income Sustainable Neighborhood Development

Problem: A developer plans a large mixed-use, mixed-income housing community but wants to embed sustainability from the start. The upfront costs are higher.

Solution: Use a green bond to raise part of the capital. The development includes green residential units, shared renewable generation, water capture, EV charging, and community gardens. Because the financing reflects these sustainability features, the economics are more feasible.

Why necessary: This provides financial structuring that matches the sustainable vision investors willing to fund green development help close the gap.

Use Case 4: Embedding Resilience & Climate Adaptation

Problem: Housing in flood-prone or heat-stress zones faces climate risk, threatening long-term viability.

Solution: Issue a green (or climate-labeled) bond to finance housing that includes adaptation: elevated foundations, stormwater management, passive cooling, drought-resilient landscaping. Over time, the development is more resilient and less vulnerable financially.

Why necessary: Investors increasingly demand risk mitigation; embedding adaptation into housing financed via green bonds ensures that resilience is built in, not retrofitted later.

How to Issue or Invest in Green Bond Financed Housing Developments

If you are a developer, public authority, or investor interested in participating, here is how to proceed:

For Developers / Issuers

-

Project selection & viability assessment – Identify housing projects where sustainability features can be integrated and meet green criteria without compromising returns.

-

Frame a green bond framework – Draft use-of-proceeds criteria, selection & evaluation process, reporting commitments, and external review mechanisms.

-

Secure external review or second-party opinion – Engage independent ESG/green bond experts to validate your framework.

-

Structure the bond deal – Work with investment banks, underwriters, or financial advisors to structure tranches, pricing, and marketing.

-

Allocate proceeds & track usage – Set up governance and systems (allocation register, segregated accounts) to ensure proceeds go to eligible housing projects.

-

Implement housing projects with green technology – Deploy sustainable design, construction, and verification technology (as per the “product” examples above).

-

Report impact annually – Deliver transparent reports (energy saved, carbon avoided, water metrics) to bondholders; consider third-party assurance.

-

Maintain compliance – Monitor performance over bond tenure; if performance falls, remedial actions may be necessary.

For Investors / Capital Allocators

-

Screen green bond issuances – Evaluate bond frameworks, second-party opinions, project pipelines, issuer credibility.

-

Perform due diligence – Review allocation registers, past impact reports, ESG risk disclosures.

-

Allocate capital – Invest in the bond issuance or secondary market, treating it as both a financial and impact investment.

-

Monitor ongoing impact – Use issuer reporting to assess whether the housing developments deliver expected environmental returns.

-

Engage or influence – Hold issuers accountable, propose enhancements to their sustainability practices, or suggest reinvestment opportunities.

Where to Access / Buy

-

Green bonds are typically available via investment banks, institutional bond desks, or ESG funds.

-

Developers can partner with sustainable finance advisors or platforms specializing in green bond structuring.

-

Some specialized climate finance intermediaries or green bond platforms might connect issuers and investors.

-

In certain jurisdictions, municipal or public green housing bonds may be available through government treasury or local bond markets.

Key Tips & Best Practices

-

Start early in design phase: Ensure sustainability metrics are baked in from architectural concept rather than retrofitted later.

-

Engage credible external reviewers: Investors rely on independent opinions to verify green credentials.

-

Maintain transparency & traceability: Implement rigorous systems to track funds, project outcomes, and reporting.

-

Adopt scalable systems: Use BIM, IoT, data analytics, and automation to reduce reporting burden and risk.

-

Balance ambition with pragmatism: Don’t overpromise; aim for realistic thresholds and incremental improvements.

-

Iterate & refine frameworks over time: As green building standards evolve, adapt your bond structures accordingly.

-

Engage community stakeholders: Residents, local authorities, and NGOs can help validate social value in addition to environmental metrics.

Frequently Asked Questions

Q1: Can existing housing developments be retrofitted and financed via green bonds?

Yes. Green bonds can be used to refinance or upgrade existing housing stock, provided the retrofits bring the development into alignment with green eligibility criteria (e.g. energy performance thresholds). The same standards for allocation, reporting, and verification apply.

Q2: How do investors ensure the housing development truly delivers environmental benefits?

Investors typically rely on the issuer’s disclosure, independent third-party opinions (second-party), periodic assurance of impact reports, and ongoing monitoring. Robust governance, transparency, and external verification are critical to prevent “greenwashing.”

Q3: Are green bonds for housing only viable in developed markets?

No. While many green bond markets are mature in Europe and North America, emerging markets (e.g., Mexico’s Vinte, South Africa’s Nedbank) are showing that green bond housing is possible in developing contexts. The key is tailoring frameworks, engaging international partners, and aligning incentives.

Green bond financed housing developments represent a powerful convergence of finance, sustainability, and affordable living. For developers, investors, or policymakers aiming to build the next generation of housing stock, mastering the structures, technologies, use cases, and tools outlined above offers a pathway to scalable, credible, and impactful projects.